- GOVPH

- About BOC

- Issuances

- Aduana Library

- Memoranda

- Memoranda for Reference Values

- Customs Administrative Order (CAO)

- Customs Administrative Order (CAO) 2025

- CUSTOMS ADMINISTRATIVE ORDER (CAO) 2024

- Customs Administrative Order (CAO) 2023

- Customs Administrative Order (CAO) 2022

- Customs Administrative Order (CAO) 2021

- Customs Administrative Order (CAO) 2020

- Customs Administrative Order (CAO) 2019

- Customs Administrative Order (CAO) 2018 and Older

- Customs Memorandum Order (CMO)

- Customs Memorandum Circular (CMC)

- Customs Memorandum Circular (CMC) 2025

- Customs Memorandum Circular (CMC) 2024

- Customs Memorandum Circular (CMC) 2023

- Customs Memorandum Circular (CMC) 2022

- Customs Memorandum Circular (CMC) 2021

- Customs Memorandum Circular (CMC) 2020

- Customs Memorandum Circular (CMC) 2019

- Customs Memorandum Circular (CMC) 2018 and Older

- Customs Special Order (CSO)

- Custom Training Circular (CTC)

- Joint Memorandum Orders (JMO)

- Trade

- News Room

- Port Updates

- HR Corner

- Quicklinks

- Infographics

- Bureau of Customs Webinar

- Auction and Sales

- Bid Opportunities

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2023

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2022

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2021

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2020

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2019

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting

- Bid Documents

- Bid Supplement

- Summary of Awarded Contracts

- Summary of Contracts Awarded 2023

- Summary of Contracts Awarded 2022

- Summary of Contracts Awarded 2021

- Summary of Contracts Awarded 2020

- Summary of Contracts Awarded 2019

- Summary of Contracts Awarded 2018

- Summary of Contracts Awarded 2017

- Summary of Contracts Awarded 2016

- Summary of Contracts Awarded 2015

- Summary of Contracts Awarded 2014

- Summary of Contracts Awarded 2013

- Annual Procurement Plan

- Customs Knowledge Resources

- References

- Gender Equality and Diversity

- Philippine National Trade Repository

- Philippine Tariff Finder

- Authorized Economic Operator

Frequently Asked Questions (FAQS)

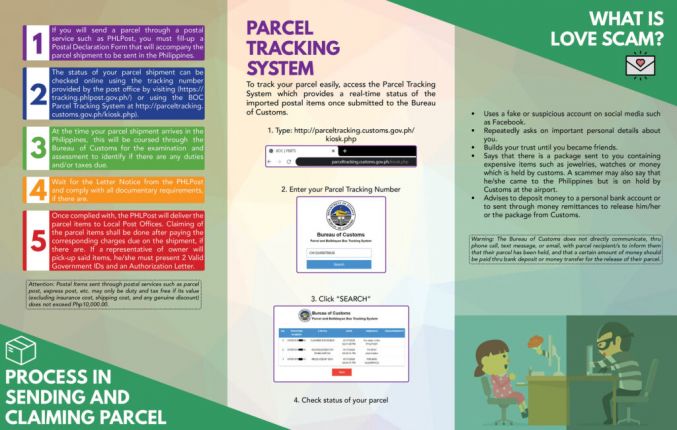

How can I track my package/parcel?

We recommend that you directly contact the AMED Support Service/EMS Customer Care. Since the tracking number they provide is generated for their internal use.

If we will not pay duties/taxes, what will happen to the package?

The parcels will be considered abandoned and will be forfeited in favor of the government and will be sold at auction or disposed of accordingly, if the goods are regulated, these will be turned over to the concerned regulatory agency.

The medicines/cosmetics/toys/processed food are for personal use and not for sale, why is there a need for permit?

Permit prior to importation is required by the concerned regulatory agency if the quantity is more than the allowable limit.

What are the other options if proof of payment such as receipt cannot be submitted because the item(s) is/are a gift(s)?

The value of the goods will be determined based on the established or reference value of the same or similar goods.

What if the value declared was for insurance purpose only and I actually bought the item for a lower price?

The basis of the computation of duties and taxes is the value declared in the Customs-Postal Declaration. Examiner will only require proof of payment if the value declared is obviously low or below the reference value of Customs.

When I track my package it says, “Held by Customs”? Please release my package.

Your parcel was temporarily on HOLD by Customs, if it needs documentary requirements, like Import Permit from regulatory agencies, Invoice, Proof of Payment, etc.

Why do I have to pay taxes for package sent as gifts?

Duties and taxes are imposed on ALL imported goods regardless of the mode of acquisition or how these were acquired except when the value of the goods does not exceed php 10,000.00.

Why is proof of payment needed?

These documents are required to arrive at a proper valuation of imported items and to ensure the proper collection of duties and taxes.

Why pay duties and taxes for donated items?

All imported goods are subject to tax when otherwise provided by law under section 800 of the CMTA and subject to the approval of the Department of Finance.

Why pay tax for second hand/used goods?

All imported goods are subject to tax if the value is more that PHP 10,000.00.

Why still pay the tax when the sender already paid at the post office in the country of origin (referring to postage fee)?

The payment made to the post office at the country of origin is referred to as “Postage Fee”. Import Duties and taxes are payable in the Philippines. All expenses incurred in the importation shall also form part of the dutiable value.

ABOUT GOVPH

All content is in the public domain unless otherwise stated.