- GOVPH

- About BOC

- Issuances

- Aduana Library

- Memoranda

- Memoranda for Reference Values

- Customs Administrative Order (CAO)

- Customs Administrative Order (CAO) 2025

- CUSTOMS ADMINISTRATIVE ORDER (CAO) 2024

- Customs Administrative Order (CAO) 2023

- Customs Administrative Order (CAO) 2022

- Customs Administrative Order (CAO) 2021

- Customs Administrative Order (CAO) 2020

- Customs Administrative Order (CAO) 2019

- Customs Administrative Order (CAO) 2018 and Older

- Customs Memorandum Order (CMO)

- Customs Memorandum Circular (CMC)

- Customs Memorandum Circular (CMC) 2025

- Customs Memorandum Circular (CMC) 2024

- Customs Memorandum Circular (CMC) 2023

- Customs Memorandum Circular (CMC) 2022

- Customs Memorandum Circular (CMC) 2021

- Customs Memorandum Circular (CMC) 2020

- Customs Memorandum Circular (CMC) 2019

- Customs Memorandum Circular (CMC) 2018 and Older

- Customs Special Order (CSO)

- Custom Training Circular (CTC)

- Joint Memorandum Orders (JMO)

- Trade

- News Room

- Port Updates

- HR Corner

- Quicklinks

- Infographics

- Bureau of Customs Webinar

- Auction and Sales

- Bid Opportunities

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2023

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2022

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2021

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2020

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2019

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting

- Bid Documents

- Bid Supplement

- Summary of Awarded Contracts

- Summary of Contracts Awarded 2023

- Summary of Contracts Awarded 2022

- Summary of Contracts Awarded 2021

- Summary of Contracts Awarded 2020

- Summary of Contracts Awarded 2019

- Summary of Contracts Awarded 2018

- Summary of Contracts Awarded 2017

- Summary of Contracts Awarded 2016

- Summary of Contracts Awarded 2015

- Summary of Contracts Awarded 2014

- Summary of Contracts Awarded 2013

- Annual Procurement Plan

- Customs Knowledge Resources

- References

- Gender Equality and Diversity

- Philippine National Trade Repository

- Philippine Tariff Finder

- Authorized Economic Operator

NOTICE TO TRAVELERS

TRAVELERS SHALL DECLARE THE FOLLOWING:

- Goods purchased or acquired abroad

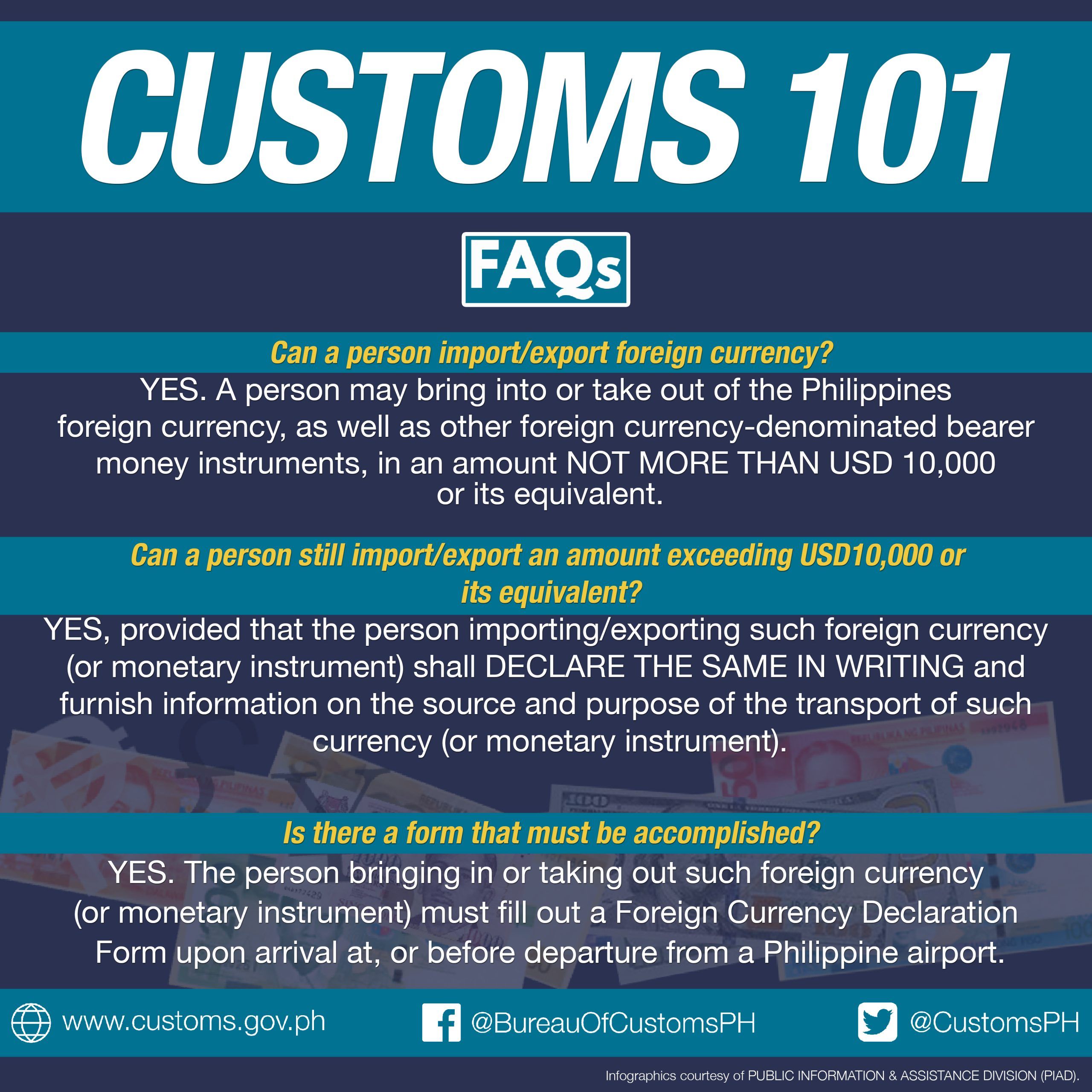

- Foreign currencies in excess of USD 10,000.00 or its equivalent in any foreign currency.

- Agricultural products or their by-products.

Please fill-out the Customs Baggage Declaration Form available at the Customs Arrival Area.

CUSTOMS MODERNIZATION AND TARIFF ACT (CMTA)

Section 104. All goods, when imported into the Philippines, shall be subject to duty upon importation, including goods previously exported from the Philippines.

Section 222. Upon reasonable cause, any person exercising police authority may open and examine any box, trunk, envelope, or other container for purposes of determining the presence of dutiable or prohibited goods. This authority includes the search of receptacles used for the transport of human remains and dead animals. Such authority likewise includes the power to stop, search, and examine any vehicle or carrier, person or animal suspected of holding or conveying dutiable or prohibited goods.

Section 223. Upon reasonable cause, travelers arriving from foreign countries may be subjected to search and detention by the customs officers. The dignity of the person under search and detention shall be respected at all times. Female inspectors may be employed for the examination and search of persons of their own sex.

Section 437. The Bureau shall provide simplified customs procedures for traveler and baggage processing based on international agreements and customs best practices.

Travelers shall be permitted to export goods for commercial pm-poses, subject to compliance with the necessary export formalities and payment of export duties, taxes and charges, if any.

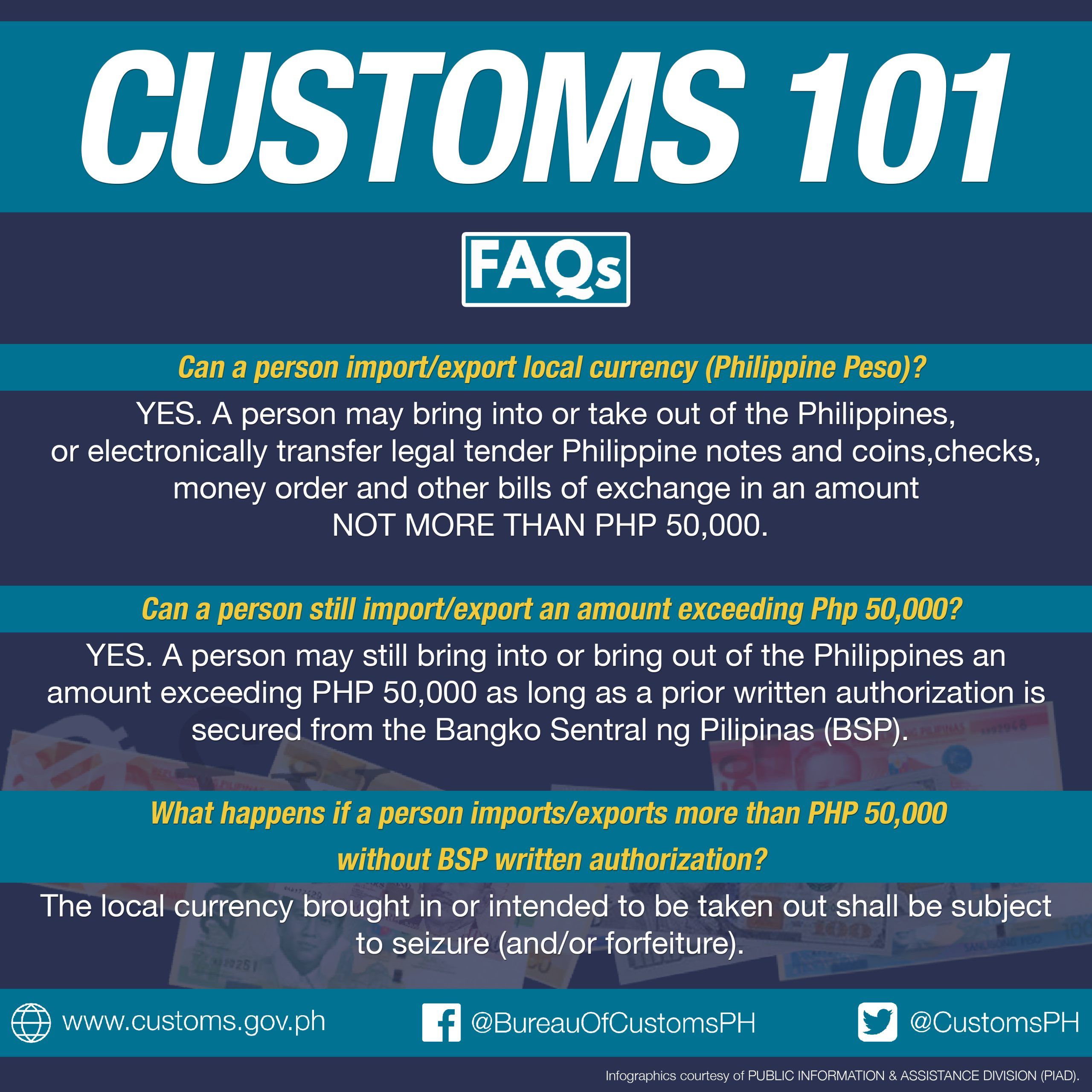

CURRENCY AND OTHER MONEY INSTRUMENTS

Philippine Currency and/or any Philippine Instruments in excess of PHP 50,000.00 or more.

No person may import or export or bring with him into or out of the country legal tender Philippin notes, coins, checks, money orders and other bill of exchange drawn in pesos against banks operating in the Philippines in an amount exceeding PHP 50,000.00 without authorization from the Bank Sentral ng Pilipinas (BSP). (BSP Circular No.992, Series of 2016, The Amendments of the Rules on Cross-Border Transfer of Local Currency)

Foreign Currency and/or Monetary Instrument in Excess of USD 10,000.00 or its equivalent.

Any person bringing in or taking out foreign currency, or other exchange – dominated bearer negotiable monetary such as travelers’ checks, other checks, drafts, notes, money orders, bonds, deposit certificates, securities, commercial papers, trust certificates, custodial receipts, deposit substitute instruments, trading orders, transaction tickets and confirmation of sale/investment in excess of USD 10,000.00 or its equivalent in other foreign currencies must accomplish a Foreign Currency Declaration Form which may be obtained from a Customs Officer at the Customs Desk in the Arrival or Departure Areas or can be downloaded from the BSP website www.bsp.gov.ph Annex K of the Manual Regulations on Foreign Exchange Transactions. (BSP Circular No.308, Series of 2001, as amended by BSP Circular No.507, Series of 2006)

ABOUT GOVPH

All content is in the public domain unless otherwise stated.