- GOVPH

- About BOC

- Issuances

- Aduana Library

- Memoranda

- Memoranda for Reference Values

- Customs Administrative Order (CAO)

- Customs Administrative Order (CAO) 2025

- CUSTOMS ADMINISTRATIVE ORDER (CAO) 2024

- Customs Administrative Order (CAO) 2023

- Customs Administrative Order (CAO) 2022

- Customs Administrative Order (CAO) 2021

- Customs Administrative Order (CAO) 2020

- Customs Administrative Order (CAO) 2019

- Customs Administrative Order (CAO) 2018 and Older

- Customs Memorandum Order (CMO)

- Customs Memorandum Circular (CMC)

- Customs Memorandum Circular (CMC) 2025

- Customs Memorandum Circular (CMC) 2024

- Customs Memorandum Circular (CMC) 2023

- Customs Memorandum Circular (CMC) 2022

- Customs Memorandum Circular (CMC) 2021

- Customs Memorandum Circular (CMC) 2020

- Customs Memorandum Circular (CMC) 2019

- Customs Memorandum Circular (CMC) 2018 and Older

- Customs Special Order (CSO)

- Custom Training Circular (CTC)

- Joint Memorandum Orders (JMO)

- Trade

- News Room

- Port Updates

- HR Corner

- Quicklinks

- Infographics

- Bureau of Customs Webinar

- Auction and Sales

- Bid Opportunities

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2023

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2022

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2021

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2020

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting – 2019

- Invitation to Bid / Request for Quotation / Invitation for Negotiated Procurement / Notice to Conduct Direct Contracting

- Bid Documents

- Bid Supplement

- Summary of Awarded Contracts

- Summary of Contracts Awarded 2023

- Summary of Contracts Awarded 2022

- Summary of Contracts Awarded 2021

- Summary of Contracts Awarded 2020

- Summary of Contracts Awarded 2019

- Summary of Contracts Awarded 2018

- Summary of Contracts Awarded 2017

- Summary of Contracts Awarded 2016

- Summary of Contracts Awarded 2015

- Summary of Contracts Awarded 2014

- Summary of Contracts Awarded 2013

- Annual Procurement Plan

- Customs Knowledge Resources

- References

- Gender Equality and Diversity

- Philippine National Trade Repository

- Philippine Tariff Finder

- Authorized Economic Operator

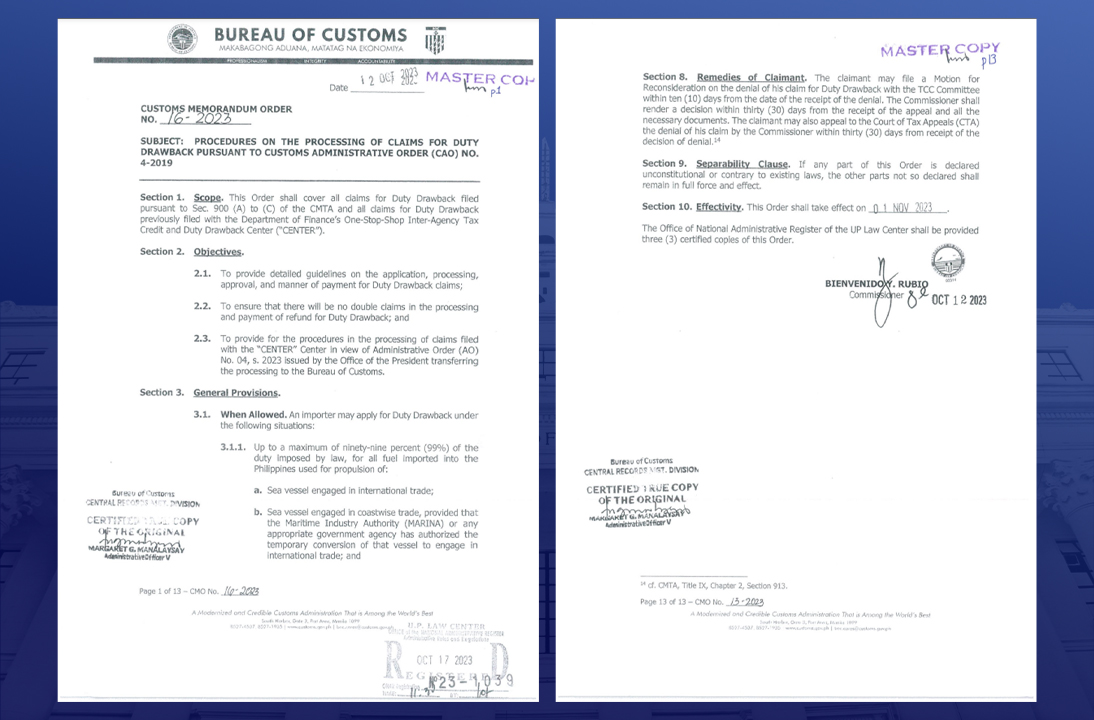

BOC issues Guidelines for Duty Drawback Claims

The Bureau of Customs (BOC) has outlined the procedures for processing duty drawback claims through the issuance of Customs Memorandum Order (CMO) No. 16-2023, in accordance with Customs Administrative Order (CAO) No. 4-2019.

This order aims to provide comprehensive guidelines for the application, processing, approval, and payment methods related to Duty Drawback claims. It shall cover all claims for Duty Drawback filed pursuant to Sec. 900 (A) to (C) of the CMTA and all claims for Duty Drawback previously filed with the Department of Finance’s One-Stop-Shop Inter-Agency Tax Credit and Duty Drawback Center (“CENTER”) in view of Administrative Order (AO) No. 04, s. 2023 issued by the Office of the President transferring the processing to the Bureau of Customs.

Claims for duty drawback shall be processed, generated, and released within sixty (60) to one hundred twenty (120) days following the receipt of properly completed claims and validated supporting documents.

ABOUT GOVPH

All content is in the public domain unless otherwise stated.